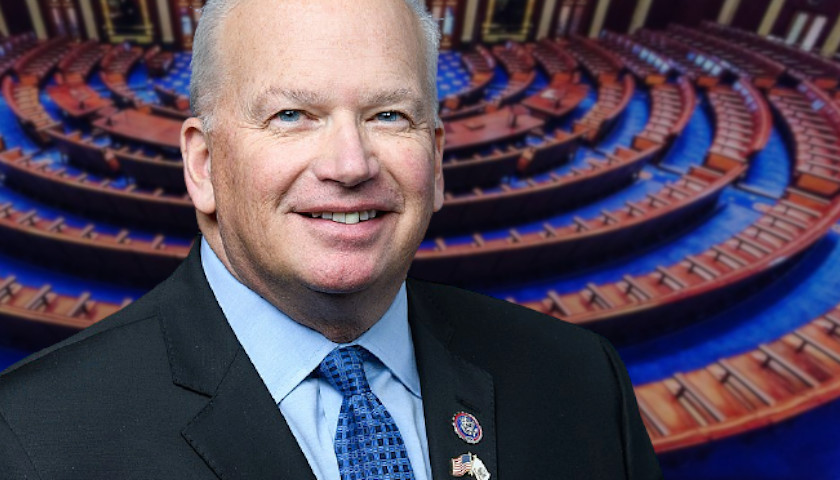

Wisconsin Representative Scott Fitzgerald (R-WI-05) signed a letter opposing suggested Internal Revenue Service (IRS) oversight of withdrawals and deposits of over $600. The letter was written by Minnesota Representative Tom Emmer (R-MN-06).

As if their tax hikes weren't enough, Dems want to invade personal privacy through mandated reporting on what goes in & out of bank and credit union accounts over $600 to the IRS. I joined @RepTomEmmer in calling out the obvious privacy & data security concerns this plan raises. pic.twitter.com/VovXRlH5sp

— Rep. Scott Fitzgerald (@RepFitzgerald) September 13, 2021

Fitzgerald said, “As if their tax hikes weren’t enough, [Democrats] want to invade personal privacy through mandated reporting on what goes in [and] out of bank and credit union accounts over $600 to the IRS.” He went on to call out “obvious privacy” and “data security” issues with the proposal.

According to the letter, the proposed legislation was intended to assist in closing a “tax gap,” which the signers believed was not a “necessary” or “helpful” step.

The letter reads, “The recent spending proposal to include new tax information reporting requirements for financial institutions would not only impose significant compliance costs on our banks, credit unions, and related financial institutions that have served as the backbone of this economy these past 18 months, but also infringe on the privacy of millions of Americans.”

The politicians said that financial institutions already report a “tremendous amount of data to the IRS” and that there was no evidence that this additional data would “substantially aid the IRS’s efforts to close the tax gap beyond the information already at the IRS’s disposal.”

The letter also touched on the possibility of data breaches, sharing a statistic that the IRS experiences “1.4 billion cyber attacks annually.” Their concern is that the IRS should not be given more sensitive data to handle considering their “multiple data breaches.” The people who signed the letter said the proposal could “make the personal financial data of millions of Americans vulnerable to attack.”

The letter also argued that the main reason individuals don’t open bank accounts is because of privacy concerns. The politicians shared their concern that the proposed legislation would “further exacerbate” the divide between the “unbanked” and “underbanked” and “banked” individuals.

They asked that they work to make an environment “focused on protecting Americans and our financial system, not one focused on raising revenue at the expense of our taxpayers and financial institutions.”

The letter was also signed by Representatives Mike Gallagher, (R-08-WI), Jim Hagedorn (R-01-MN), Diana Harshbarger (R-01-TN), Chuck Fleischmann (R-03-TN), Mary Miller (R-15-IL), Blake D. Moore (R-01-UT), Kat Cammack (R-03-FL), Mike Rogers (R-03-AL), Darin LaHood (R-18-IL), Devin Nunes (R-22-CA), Trey Hollingsworth (R-09-IN), Mike Bost (R-12-IL), and Burgess Owens (R-04-UT).

– – –

Hayley Tschetter is a reporter with The Minnesota Sun | Star News Network. Follow Hayley on Twitter or like her Facebook page. Send news tips to [email protected].